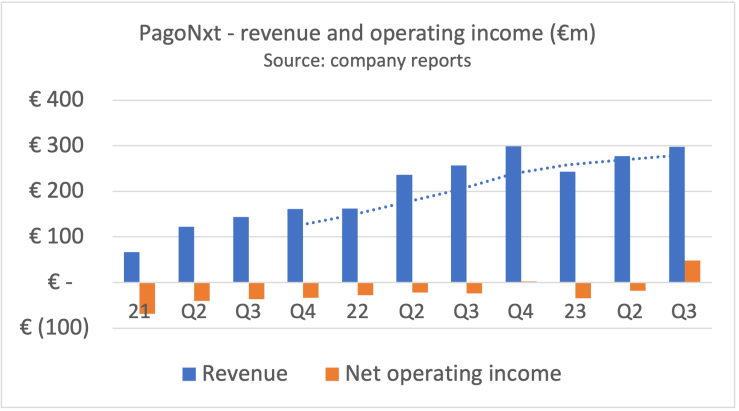

PagoNxt, Santander’s payment unit, saw the benefits of platform consolidation and economies of scale as it announced a second successive quarter of strong profits in Q4 2023. Reporting 25% EBITDA margins, management says that higher profits are primarily due to increasing scale, increased VAS penetration, and a greater share of eCommerce and vertical solutions.

Ana Botin, Executive Chair of Santander said: “We have a unique position. We are on both sides of the value chain. We will use this to become a global leader in payments… We’re driving customer growth by offering a bundle proposition.” This is a claim which most banks could make but Santander is one of the few making a success of the strategy.

The very positive Q4 financial performance follows Santander’s decision to in-source and consolidate its payment activities. PagoNxt comprises all of Santander’s payment assets, including Getnet, a leading multi-national merchant acquirer, Ebury, trade finance, Payments Hub, “already one of the largest processors of A2A payments in Europe” and Superdigital, a financial marketplace for the economic inclusion of the underbanked.

Total merchant payment volume at Getnet was up 19% to €57bn with strongest growth in Europe where volume rose 31% year on year, driven by good results in Spain and Portugal. In the UK, Getnet is “currently operating with a reduced number of customers under our UK FCA licence.” Management says that Getnet Europe has introduced a new vertical solution for airlines and stronger value-added propositions for SMEs.

Mexico volume was up 23% with Brazil growing more slowly at 14%. The new business in Chile increased volume 80% from a low base. PagoNxt says it is now the third largest merchant acquirer in Latin America.

For 2023 as a whole, volume was €206bn, up 22%. Total transactions increased 29% although PagoNxt has stopped reporting the actual number.

Revenue rose 7% to €321m, due mainly to higher merchant volumes at Getnet and strong performance at Ebury. PagoNxt is tasked with growing its business outside of Santander’s banking relationship. 15.8% of revenue in 2023 was “open market”, up 2.2 percentage points on 2022.

Expenses fell 9% to €268m. Payments carries high fixed costs.. As volume has grown, the cost per transaction processed at Getnet fell 16% in 2023 to 3.5c.

Net operating income was €53m, up from €3m same quarter a year earlier, yielding an impressive operating margin of 17%. The EBITDA margin was 24.8% (up 15.7pp on 2022) and management is confident of hitting its 30% margin target by 2025.

Looking ahead, PagoNxt management is focused on scaling its global platform, strengthening distribution through Santander especially to SMEs and maximising the “open market” opportunity through partnerships with ISVs and financial institutions.