Significant write-downs at PagoNxt, Santander’s merchant payment business, masked a good underlying performance reported with the bank’s Q2 2024 financial results. Notably, economies of scale in payment processing helped double EBITDA to €69m.

PagoNxt was created when Santander consolidated its payment assets into a single unit containing Getnet, a multi-national merchant acquirer, Ebury, a London based trade finance specialist, Superdigital, a Latin American financial marketplace for the economic inclusion of the underbanked and PagoNxt Payments which offers wholesale A2A capability based around its Payments Hub.

Santander has now set about rationalising this portfolio. Ebury is to be floated on the London stock exchange at a valuation of c.€2bn and the German operations of Getnet, originally rescued from the ashes of Wirecard for €100m, have been closed with the loss of 350 jobs in Munich. The retreat from Germany resulted in €170m of write-downs charged in Q2 and this comes in addition to a €73m hit from the shutdown of the original Superdigital technology platform.

The refocused Getnet is the second largest acquirer in Latin American and has good positions in Spain and Portugal where it sells through Santander’s large domestic banking networks. Santander also has a strong footprint in the UK where Elavon is the bank’s preferred payment partner today. It’s not clear if or when Getnet will replace Elavon in this relationship.

Returning to the Q2 2024 results, global merchant payment volume at Getnet rose by 9% to €54bn. This is the slowest increase in volume yet reported by PagoNxt and reflects the impact of the loss of its German merchants. ATV ticked up 6% to €20.85.

Payments Hub which offers a single API connection into a number of A2A platforms including SEPA, Faster Payments and SWIFT, is growing fast from a low base. Total transactions increased from 79m to 405m in the first half of 2024.

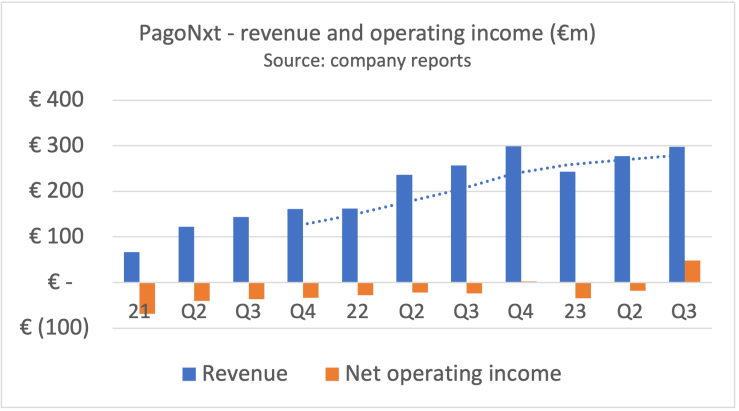

PagoNxt is successfully turning increased volume into sales revenue. Turnover was up 8% to €300m with the good performance attributed to Getnet in Europe, Chile and Mexico, where it deployed DCC for the first time, as well as higher sales at Ebury.

Management is keen to reduce its dependence on Santander and was pleased to report that 22% of total PagoNxt revenue is “open market”, that is sourced from its own distribution, compared with 14% last year.

Higher volumes have begun to deliver economies of scale. Unit transaction costs at Getnet fell 9% to 3.7 cents, allowing operating expenses to hold steady at €297m despite the growing size of the business.

PagoNxt is now consistently profitable on an underlying basis. EBITDA doubled to €69m in Q2 as the margin grew 8pp to 20.1%. Management believes that it is on course to reach the medium term target of 30% EBITDA margins.

Net operating profit before the write downs was €4m compared to a loss of €18m in the same quarter of 2023. After the write downs, PagoNxt lost €258m.