Press reports and analyst comments indicate that PayU’s businesses outside of India and Turkey are for sale in a process being run by Bank of America. Worldpay, Rapyd, and Nuvei are said to vying to take control of the emerging market PSP. The target price is said to be $250m.

PayU is owned by Prosus, the Amsterdam-listed investment unit of South African Naspers, which hit the jackpot as an early investor in Tencent. Prosus has published its results for the year ending March 2023, shedding some light on PayU’s recent performance.

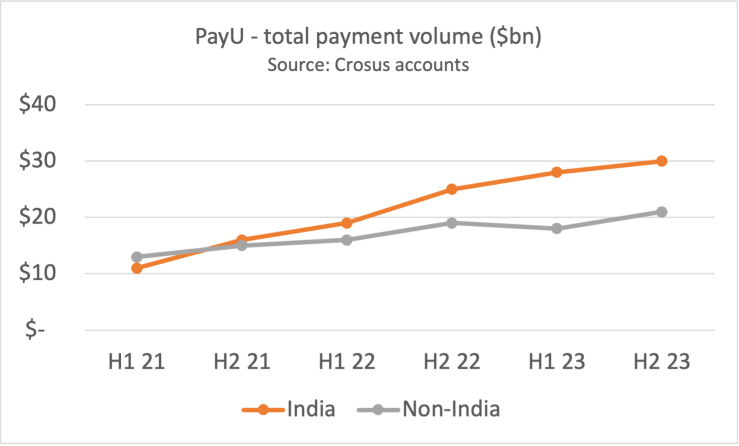

PayU’s payment volume grew 23% in FY 2023 to $97 billion. Most of the growth came from its 8m SME customers in India. Volume processed on the subcontinent rose 32% to $58 billion. What management describes as its Global Payments Organization (GPO), which includes all PayU business outside India, saw volumes rise just 11% to $39 billion.

Revenue from PayU’s core PSP business grew 23% to $792 million, driven by a strong performance in India and Turkey. Sales in India overtook the rest of the world for the first time, recording a turnover of $399 million, a rise of 31%. Outside India, revenue was up a more modest 15% at $393 million. Of this figure, roughly one third comes from Turkey (not included in the sale process) and another third from Poland (which is).

ATV was up 5% in India to $40.39 and remained flat outside India at $31.45.

The take rate in India was flat at 0.69% but rose 4 basis points in the rest of the world (RoW) to 1.01%. PayU provides eCommerce gateway services and payment orchestration but is not an acquirer, so a 1% take rate is reasonable. It represents an average revenue of 30 cents per transaction.

PayU recorded a trading profit of $11 million in India with a margin of 3%. Outside India, PayU lost $14 million, although it would have made a small profit except for a £23 million provision “related to merchants in Brazil and in the travel industry.”

PayU also booked $143 million in revenue and a trading loss of $27m on its 21% minority stake in Remitly.

Divesting the non-Indian and Turkish PayU businesses makes sense. These other markets are growing slowly and, collectively, are barely profitable. A trade buyer should be able to find plenty of synergies although the numerous technical platforms might be challenging to integrate. PayU also brings scale in Poland where it includes the former Allegro Payments, spun out of Europe’s leading online marketplace which was formerly owned by Naspers. PayU Poland recorded revenues of $248m in 2021. You can read more at Cashless.pl.

Of the three potential suitors, Rapyd has the strongest emerging market focus today and probably best understands this corner of the payment world. On the other hand, Worldpay badly needs a growth story to tell when it demerges from FIS in early 2024 and PayU might fit the bill. As for Nuvei, it has Ryan Reynolds on its share register so anything is possible.

Pay U has built its business largely through acquisition. Key purchases include:

Wibmo – Indian based white-label payment gateway bought by Pay U for $70m in 2019. Wibmo claims to have 160 bank and fintechs as customers in over 30 countries processing over 3bn transactions annually. Pay U laid off 150 staff in India at the end of 2022

Citrus Pay – a mobile wallet and gateway business operating in India, bought for for $130m in 2016. Citrus Pay claims $3bn processed annually.

Zooz – one of the first payment orchestrators, Israeli based Zooz was bought by Pay U in 2018, reportedly for between $80 and $100m. Zooz technology is at the heart of Pay U’s “payments hub” which connects its various technical capabilities.

Red Dot Payment – based in Singapore, Red Dot offers an webshop in a box, including payments, for micro merchants. Pay U acquired the business at a $65m valuation in 2019.

Iyzico – Pay U purchased this Turkish POS and eCommerce PSP with mobile focus for $165m in 2019. H&M, and Decathalon are customers. Iyzico processes 65bn lira annually which is around $2.5bn today at today’s exchange rates.

[…] is also rumoured to be one of three potential bidders for those parts of the sprawling PayU empire lying outside the PSP’s growth […]