The Payment Business

February 1st will be remembered as Worldpay’s Independence Day as it separated from FIS after the catastrophic $43bn acquisition in 2019. Worldpay has been spun off into a joint-venture with GTCR, a large Chicago based private equity fund, at a valuation of $18bn. You may have noticed $25bn missing. This is a loss to FIS shareholders for which nobody has apologised.

GTCR, which has little previous apparent interest in fintech, bought 55% of Worldpay for $13bn in cash and has committed a further $1.3bn for “strategic acquisitions.” These will likely focus on closing Worldpay’s product gap with Adyen and Stripe through extra capability related to servicing platforms/ISVs and on expanding Worldpay’s international POS capability to serve global, omnichannel retailers.

I asked Bing’s image creator to comment on the news. Surprisingly, Worldpay haven’t yet been in touch for the image rights.

Barclays, owner of Barclaycard, the UK’s second largest acquirer, has turned to private equity to rescue its underperforming payment division after having failed to find a trade buyer. Worldline, Nexi or Global Payments aren’t interested but Barclays is reportedly still looking for £2bn at 6.5x EBITDA.

The French do things differently. One week after Worldline appointed bankers to help avoid a possible hostile takeover triggered by its collapsing share price, Credit Agricole appeared as a white knight, taking a 7% stake. Worldline and Credit Agricole recently announced a JV and the French bank has a strong interest in ensuring Worldline goes through with the deal.

In Italy, Nexi is vying with Worldline for the merchant business of Cassa Centrale Banca, a group of 66 regional co-operative banks. CCB processes €2.2bn annual volume from 25,000 POS terminals and is looking for a valuation of €70-€100m. BCCPay, which recently scooped Nexi for a partnership with Banco BPM, and Market Pay, an aggressive new acquirer spun out of Carrefour, are also believed to be in the running.

Turning to Germany, Global Payments is forming a JV with Commerzbank. The new business, snappily called Commerz Globalpay, is 51% owned by Global Payments and will sell products to the bank’s large domestic corporate and SME customer base. While Commerzbank could be a great distribution channel, German banks are notoriously bad at lead generation. Fiserv launched a similar venture last year with Deutsche Bank which is reportedly underperforming.

There seems little prospect of many payment companies floating on public markets this year. According to one VC, many still haven’t adapted to today’s business conditions: “Where you have massive… processing volumes, but you’re still making negative margins, [this] is no longer acceptable.”

One exception maybe Klarna which looks likely to IPO in the US in the first half of this year but may have been making pre-flotation cost cuts too enthusiastically. Klarna’s new outsourced customer service operation has been leaving merchants to wait up to a month for their support requests to be reviewed. Staff say they no longer have direct access to Klarna systems and are using a “desperately slow” virtual desktop.

Stripe is also an IPO candidate for 2024 and rumoured to be preparing for floatation by raising prices and being much more discriminating about which customers it is prepared to onboard. One industry expert reports Stripe’s “out of the box API pricing” is 2x3x higher than a year ago. Higher prices and more cautious risk policies may trouble some of the fintechs and ISVs which have built their businesses on Stripe.

In case you missed these stories from from the Business of Payments blog:

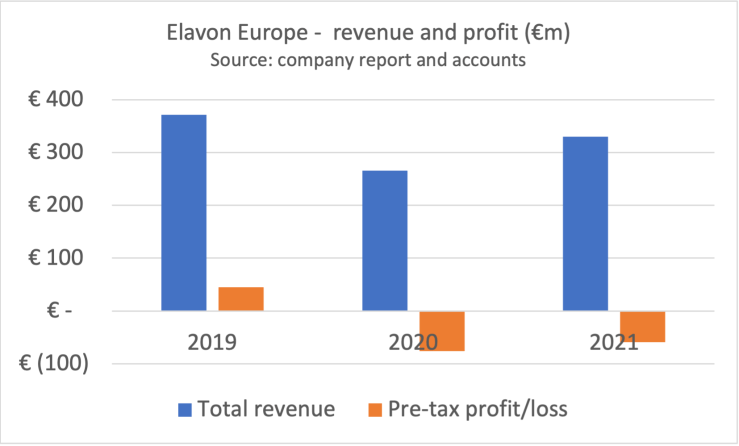

Elavon Europe posts its first profit since 2019 and revealed it had €3.2bn of airline tickets sold but not delivered on its books.

Allpay, the UK public sector specialist, reported a very positive set of results. Few other payment companies can boast 21% revenue growth and 16% operating margins.

Lemonway, one of the last marketplace payment specialists still in independent hands, impressed with revenue doubling and a maiden operating profit in 2023.

Trustly, one of the European leaders in A2A payments, reported a difficult 2022 as it recovered from a tricky situation with the Swedish regulator.

January trading updates had contrasting impacts on two London-listed payment companies with roots in carrier billing and names like childrens’ TV characters.

Boku, which is shifting its business towards global APMs competing with Thunes and dLocal, reported payment volume up 16% to $5.0bn and sales up 26% to $38m for H1 2023. Less happily, Bango, which has stayed closer to its original telco customer base, downgraded earnings expectations and lost 40% of its market capitalisation. Management says that new, value-added services are proving slow to deliver cash profits.

Checkout.com is the latest vendor to be designated a “significant provider” of card-acquiring services to SMEs in the UK and brought within scope of the Payment Systems Regulator’s directions. Checkout is normally associated with enterprise merchants, but its good performance is thought to be thanks to a growing PF relationship with Mollie, the Dutch PSP which has begun selling to UK small businesses.

Ant Group, the giant Chinese technology group behind Alibaba and Alipay, has made a smart move into European merchant payments with the proposed acquisition of MultiSafepay. This Amsterdam-based acquirer brings a modern omni-channel technology platform (with Sunmi POS terminals) and 18,000 SME customers but the $200m price tag is expensive. MultiSafepay made a net profit of just $1.4m on sales of $50m in 2022.

New shopping

Just walk out is the new self-checkout, concluded Primark’s Chief Architect after a visit to this year’s NRF Retail Show in New York. Although we’ve not seen much activity in the clothing sector, autonomous grocery and convenience openings are coming thick and fast.

Netto has opened what it claims to be Europe’s largest autonomous store in Regensburg, Germany. The technology is from Trigo and, at 800 sq metres with 5,000 SKUs, this is very impressive. Helpfully, fruit and vegetables are automatically weighed and added to the virtual basket when you take them off the shelves.

Trigo is also behind Aldi’s new SHOP&GO check-out free store in Greenwich, south London. There’s no need to download an app, just tap your payment card, or phone, at the entry gates.

You can get an idea of the potential of autonomous technology with this implementation at a UK football club which could eliminate the long queues inevitable when everyone wants to buy a drink at half-time. Sodexho, the catering company, runs the outlet. The technology is from AiFi.

In biometric news, Carrefour’s franchise partner in Qatar is trialling a Face Pay product from PopID, a Californian vendor with 73 merchant locations live in America. It’s really not clear why this is better than Apple Pay. Network International is processing the transactions with payment data tokenised by Visa.

Credit Agricole’s decision to launch a biometric payment card is equally unconvincing. The main advantage is not having to remember your PIN for transactions greater than €50, but this is what Apple Pay is for. Even the French bank’s supplier can see the writing on the wall. Zwipe is shuttering its biometric payment operation to focus resources on access control.

Despite every consumer carrying biometric ID in their personal phone, investors won’t give up on this. Polish fintech, Payvein, just announced fresh funding for its payment service based on Hitachi’s finger vein recognition technology.

What better way to give the thumbs down to biometrics than with AEVI’s suggestion of gesture based payments? The concept seems to involve waving at the payment device with a pre-registered hand signal. Presumably, not a rude one.

Cooking commerce may be a more fruitful concept. Kroger, the US retailer, has partnered with GE so you can buy groceries direct from the LCD screen on your oven. The new service was delivered via a software update to 150,000 domestic appliances.

Product

Apple, under pressure from the EU competition authorities, has finally opened up the iPhone’s NFC chip to 3rd party banking and wallet applications. The move may allow banks to bypass Apple Pay and its c.15bps charges. More excitingly for consumers, this service could facilitate a new market for open banking payments at POS. Mike Kelly explains how this might work. Excitement levels vary across Europe as Apple’s market share ranges from 55% in Denmark to just 10% in Poland. And the ruling excludes the UK. Because Brexit.

For years, PayPal had the best, friction-free online checkout in the business but this advantage has been eroded by Apple Pay, Stripe and others. These new checkouts also move fraud risk to the issuer which makes them more popular with merchants.

PayPal’s set of new product features should help claw back some of the lost ground, especially in Germany where it is still the number one eCommerce payment method. PayPal’s massive global base of 400m customer accounts and 25m merchants means its new one-click checkout recognises 70% of shoppers and is claimed to cut checkout time by more than half.

PayPal may soon need to worry about Shopify too after the eCommerce platform vendor began offering its Shopify Pay one-click checkout to non-Shopify merchants.

The product could help merchants benefit from faster checkout where Shopify recognises the customer although the fees will likely be higher than a standard payment gateway. Amazon tried something similar with Amazon Pay although this proposition has struggled and recently announced layoffs. Unlike Shopify, merchants view Amazon as a competitor and avoided offering Amazon Pay if they could.

Shopify is an absolute beast. Its head of engineering says he accepts 23,000 lines of code each weekday and the platform’s app servers handled 60m requests per minute on Black Friday. Blimey.

Irish customers will be delighted they can now use their Revolut card to buy a ticket on the Aer Lingus website. Revolut Pay, a new product, transforms what looks to the cardholder like a debit card transaction into an account transfer. Aer Lingus is reporting impressive performance. Cart abandonment rates are sub 10% and authorisation rates at 98.5% which is pretty good for the airline industry. Published merchant fees for Revolut Pay start at 1% + 20c.

Back in the real world, one obstacle to the growth of the circular economy is how to pay people for products sent for recycling. The Danish city of Aarhus has a solution with this reverse vending machine for disposable coffee cups. People get their deposits back by tapping their payment card. TOMRA provides the machinery and Shift4 the payment processing in this clever use of the Visa Direct and Mastercard Send products.

In car commerce news, KIA looks to be joining the number of automotive manufacturers launching payment products to help customers purchase upgrades, refuelling/EV charging and parking. KIA CarPay is likely to be a sister product of Hyundai Pay, already launched in the US.

Computop, the German PSP part owned by Nexi, launched its “Pay to Drive”proposition for EV charging stations using the PAX IM 30 unattended terminals. Computop already has a good customer base in this sector including Compleo and Mercedes Pay for in-car payments.

In scheme news, Carte Bancaire has finally launched an account updater service with the unfortunate Franglais brand of Updat’R. Adyen, MONEXT and Lyra are the first PSP’s to offer the new product.

FX loading can often be a guilty secret in the payment industry. Many vendors depend on marking-up foreign currency transactions for a considerable proportion of their profits and can be vulnerable if their larger customers start to scrutinise their bills too closely. New research from FXC shows how the US providers charge extra fees to their international merchants.

In rare good news for ACI’s merchant business Co-op, a UK grocer with over 2,400 stores, has moved its payment processing into the US vendor’s cloud in what it describes as a “very challenging and complex project.”

Cash

Public policy is turning to how cash can be saved from extinction. The Swedish government has demanded proposals to safeguard access to cash despite the public’s clear preference for electronic money. Only 8% of Swedes used cash for their most recent purchase.

As usage declines, cash becomes more and more expensive to provide. In Warsaw, the city government is moving to digital payments for parking, saying costs are just 5% of collecting cash from parking meters.

As people need less cash, the fixed costs of running ATM networks are spread over fewer transactions and many locations become uneconomic. In France, three big banks are pooling their ATMs and plan to reduce their number by 30%.

Ireland will be legislating to stem the decline in ATMs following a 30% reduction in cash withdrawals since before the pandemic. Grocery shops and pharmacies will also be obliged to accept cash payments despite the cost burden this will impose on these businesses.

Financial inclusion is normally the reason cited for mandating cash acceptance but this argument ignores the huge benefits of bringing people into digital money. As this new report from the Atlanta Fed explains, people excluded from digital money are also excluded from much of the rest of the economy too. For a plain English description of financial exclusion, read this description of the business of cheque cashing in the US. A cash economy rips off the poor.

Germany is an exception, of course. Where else would Arnold Schwarzenegger be frogmarched to a bank to withdraw €35,000 in cash to cover customs charges on his Audemars Piguet watch?

SoftPOS

It’s still early days in the emerging SoftPOS market but Rubean looks like one of the European winners, having locked down a number of solid distribution partnerships and two enterprise customers in Spain. Read more on the Business of Payments blog.

Softpay.io, based in Denmark, is another independent vendor making solid progress, including a potentially lucrative partnership with Nexi. Softpay has put its solution live at the Gebr Heniemann store in Copenhagen Airport. Snabble, a German start-up specialising in mobile ePOS, is providing the software application.

There is €8bn of payment volume on meal vouchers in France so it’s a smart move by Viva (JP Morgan’s European JV) to add Titre-Restaurant to its SoftPOS product.

MagicCube, based in California and one of the first wave of SoftPOS vendors has announced a go-to-market partnership with Shift4. The move comes two years after Shift4 invested in MagicCube and is likely to see the product come to Europe following the American acquirer’s merger with Finaro.

Finally, Worldine’s SoftPOS will come pre-installed on range of Hammer ruggedised smartwatches, tablets, laptops and smartphones supplied by Poland’s mpTech. Customers will still need to open a merchant account with Worldline but the move does open an interesting distribution channel with blue collar trades.

Open banking

Bain, the consulting company, says that 2029 will be the year card transactions finally stop growing. But Dave Birch thinks we might be even closer to “peak card” than this, especially if large merchants integrate variable recurring payments (VRPs) into their apps. VRPs are the open banking substitute for both direct debits and card on file and promise a better customer experience for consumers at lower cost to merchants.

For the moment, open banking reality is some distance from this promise. A new study shows French banks rejecting 47% of payment transactions using their open banking APIs. “Is this the worst in Europe?” “ask the authors. “Far from it” reply the PSP’s. Portuguese banks are certainly worse. With standard bank API’s so difficult to use in many European markets, it’s no surprise that local schemes linked to SEPA Instant Payments such as iDEAL in Holland or Blik in Poland are prospering.

If the banks are to meet the challenge of producing better quality API’s they clearly need some help. Ozone API in London has raised £8.5m to commercialise its service that enables banks to offer open banking APIs.

The UK was first into open banking but, six years after the adoption of PSD2, the sector is having a long, dark night of the soul. As this good round-up demonstrates, there have been plenty of awards for open banking innovation but nobody is generating many transactions.

Ciaran O’Malley from Trustly posted a killer chart on LinkedIn which shows the extent of the commercial challenge for VRPs. In a two-sided market, there are few win-win scenarios.

This is why the Payment Systems Regulator (PSR) is proposing that the country’s largest banks will be mandated to offer VRPs at zero Interchange for government, utility and regulated financial services.

But at the last count, there were a remarkable 556 third party processors listed in the EU and UK together. This is certainly too many and it’s certainly time for a vendor shake-out.

Crypto corner

One of the many reasons Bitcoin has not replaced fiat money is that cryptocurrencies are horribly insecure, often run by crooks and with a terrible customer experience. As Dave Birch put it, “no sane person wants to be their own bank.”

Even though 2023 was a quiet one in crypto land, criminals still made off with $1.8bn worth of digital assets from unsuspecting punters, exceeded only by the $5.8bn of fines paid by crypto and fintech groups for lax anti-money laundering checks. Advances in quantum computing could quickly makes things worse as criminals learn to break encryption even faster. Caveat emptor.

The early hype around crypto set in train projects to launch central bank digital currencies (CBDCs). The Bank of England (BoE) received over 50,000 responses to its public consultation on the digital pound. Many of the concerns expressed were around privacy. The Bank promises that it won’t be able to see your individual transactions, but this won’t placate the zealots.

Any decision to launch Britcoin will be taken “around the middle of the decade” at the earliest but the BoE hasn’t answered the fundamental question of what a Central Bank Digital Currency (CBDC) is for. Neither does this video from the European Central Bank (ECB) shed much light on why anyone would want a digital euro rather than using Apple Pay.

The European Central Bank has begun tendering for some of the components of the digital euro. Worldline, Nexi and the EPI were involved in earlier prototyping exercises and will likely be bidding for the next set of contracts, valued at up to €1.1bn.

Research round-up

Cap Gemini’s payment trends for 2024 places real-time treasury and tokenisation in the top right quadrant. The consultants also see the card market growing in volume but losing share to A2A payments.

A summary up of 2024’s payment topics from the Finanz-Szene blog including wero, real-time bank transfers in Germany (at last) and the implication of TA 7.2 standards for payment terminals. A huge number of devices need replacing in Germany, notably the Verifone H5000s.

An Airwallex survey of SMBs highlights the embedded finance opportunities for payment providers. One interesting finding is that there is very little brand loyalty. 82% of merchants say they would change payment provider if their ISV offered a similar solution.

Chargeback 911’s annual Cardholder Dispute Index is always worth a read, if only to gasp at the average 5.7 disputes raised by each consumer every year in the USA.

35% of global eCommerce sales now go through marketplaces according to an absolute goldmine of omni-channel retail research available free of charge from RetailX. Retail CIOs themselves are planning major system upgrades to meet the needs of channel hopping consumers. This will likely trigger reassessments of their payment suppliers and is yet more bad news for incumbents saddled with legacy platforms.

In other news

UK retailers spent a whopping £1.27bn on card processing fees in 2023 and the British Retail Consortium is particularly annoyed about the 27% rise in scheme fees. The trade body is proposing that larger transactions should be charged as a fixed fee, not ad valorem; an idea likely to meet fierce resistance from the schemes.

Wirecard update – the stooge director of Wirecard’s (allegedly fake) Singapore operation claims he was paid $11,000 a month for signing documents he didn’t read. Nice work.

Your staff no longer need to waste time producing poor quality PowerPoint decks. The robots can make bad presentations too. Watch this demo where Microsoft Co-pilot creates a dull but entirely adequate deck in just 47 seconds.

One key application of AI is to automate customer service but you need to keep an eye on your robots otherwise they may start thinking for themselves. One AI chatbot working for DPD, a UK parcel delivery company with a mixed reputation, wrote a poem about how bad its employer was.

Where to find me

I’ll be moderating panel discussions at MPE in Berlin on 12-14 March and ePay Europe in London on 21 May. In between, you can catch me at Retail Expo in London on 24/25 April.

Alternatively, If you liked this newsletter, you can hear me guesting on Worldline’s Navigating Digital Payments podcast. .

Get in touch

Geoffrey Barraclough

geoff@barracloughandco.com