Shift4 is certainly one of the more interesting payment businesses and pretty much the only one to have made a demonstrable success of payment/software convergence. Keen to find out more, I was delighted to join a small crowd of Fintech analysts for a ringside seat at the company’s Investor Day in Las Vegas last week.

Jared Isaacman (below) founded the business 26 years ago and this was his last public event before taking a new job running NASA. Despite his track record of business success, Isaacman is now best known for paying a reported $200m to Elon Musk for space flights.

You can view the whole deck here but first read what I learned from the presentation and side-conversations with the analysts and Shift4’s exec team.

Shift4 feels good about itself. Management is very pleased that the business comfortably exceeded the ambitious targets published at Shift4’s last investor day in 2021. So far, so good but analysts weren’t happy with guidance for 2025 and continue to be nervous about execution risk in Shift4’s acquisition led growth strategy. The stock price tumbled 20% during the week.

Investors are also worried about the change at the top of the company. Jared Isaacman is clearly a very well-liked and respected CEO who leaves the business in fine shape. It’s a tough act to follow. Isaacman, who remains the majority shareholder, has handed some rather demanding objectives for his successor. Taylor Lauber, the incoming CEO, must deliver 30% CAGR revenue and EBITDA over the next three years (see chart below). Meeting the very bullish earnings guidance will require continued flawless execution. There’s not much room for error. Hence the wobbling stock price.

It was probably a mistake to run the Investor Day directly after the Q4 results call. The analysts, busy tapping numbers into their spreadsheets to prepare buy/sell notes that evening, weren’t paying enough attention to the strategy presentations that followed. Undoubtedly, there is risk in execution and succession, but the Shift4 strategy is coherent and well-evidenced.

Two thirds of future growth is forecast to be organic with the remainder coming from cross-selling payments to the customer base of Global Blue and other acquisitions. I’ll come back to Global Blue a bit later, but this deal alone is said to boost Shift4’s target addressable market from $800m to $1.4 trillion by giving a right to play in European retail (see chart below).

Shift4 is focused on verticals where it has a differentiated right to win, weak competition and where there is a strong opportunity to cross-sell payments to software customers. The strategy has been successfully executed with restaurants, hospitality and sports venues in the US. Shift4 plans to take these products global. Retail, a new focus after the Global Blue deal, is more competitive, from both a payments and software perspective, and likely to be a tougher task.

Shift4 takes a vertically integrated approach to its restaurant and hospitality software products (now all called SkyTab) and includes software, hardware, payments, gift cards and installation in the bundle. This means Shift4 can replace four or five vendors for a typical operator. Consolidating multiple payment and software relationships into a single solution from one vendor reduces complexity and cost of ownership for the merchant but also means that Shift4 doesn’t have to compete on price. One of the strongest differentiators is a large library of integrations into 3rd party services such as booking engines, loyalty programmes, ERP systems etc which makes SkyTab hard for competitors to dislodge.

The focus on developing new software features in response to customer demand has helped move Shift4’s merchant base upmarket. The massive resort in Las Vegas where the Investor Day took place ran pretty much all is POS software and payments through Shift 4. Large customers bring bigger payment cross-sell opportunities and don’t go bust as often as small ones. This improves customer lifetime value while keeping acquisition costs under control.

Shift4 is internationalising quickly and will soon be a significant competitive threat to the European incumbents such as Worldline and Nexi. 20% of revenues come from international business today, almost all from Europe. 30% of new merchants signed in Q4 were from Europe and post Global Blue, two thirds of the headcount will be in Europe.

International growth has been based on the Finaro acquisition and, so far, has been primarily from acquirer/processing rather than software. Since joining Shift4, Finaro has doubled its sales and EBITDA while growing POS from 3% to 30% of revenue. Shift4 has now launched SkyTab in the UK and will shortly begin sales in Germany.

Shift4’s growth has been founded on its ability to buy businesses and cross-sell its products to the expanded customer base. It has built a remarkable acquisition machine. Management has demonstrated a clear rationale for buying businesses, a proven screen for choosing the right ones, a keen eye for a bargain and a ruthless process for delivering synergies. I’m impressed but Shift4 has sometimes struggled to convince a sceptical investor community that it can succeed where many have failed

The company’s strategy team has certainly been busy. Shift4 evaluated 300 deals in 2024, did due diligence on 50, made offers of interest on 15 and executed 5. Shift4 says it only works on deals sourced in-house and doesn’t play when bankers send round teaser documents. Interestingly, the last three acquisitions – Givex, Vectron and Global Blue – were all unloved stock-market listed companies with bombed out share prices. No secrets here. The targets were hiding in plain sight.

The main reason for the acquisition led strategy, according to Shift4’s execs, is that it’s cheaper to recruit customers by buying businesses than through direct sales or digital marketing. Shift4’s rule of thumb when evaluating acquisitions is to be able to buy merchants at or below $1000 each and then spend $2000-$3000 in incentives (sales commission and free hardware) to move them to SkyTab. Management contrasted this with Toast’s cost of acquisition which they say is closer to $17,000.

Shift4 has been particularly successful at integrating businesses; keeping what it needs and closing what it doesn’t. Customers of acquired companies are made a good offer to come to Shift4. If they don’t accept, prices rise, and service drops until they change their mind. It’s risky and requires strong nerves but it’s working.

A strong PMO is a competitive advantage. A team of 12 gets involved from the due diligence stage to have an integration plan ready to go on day one. Management gave the example of Appetize, a stadium software vendor which Shift4 bought in 2023. Its best developers were immediately moved to work on Shift4’s go-forward product. 15 months later, 70% of customers had made the switch.

In Europe, the Vectron acquisition is reportedly going well. Vectron, a restaurant software vendor based in Germany, has 65,000 merchants and sells through a network of 300 dealers. Payments had been almost entirely ignored. Shift4 has launched a payment service called Vectron Smart at €34.99/month (including two PAX terminals) and 1.29% per transaction. The Vectron dealer network is reportedly very excited and has already “sold hundreds.” I wouldn’t be surprised to see Vectron’s best developers already working on localising SkyTab for Germany.

There’s a strong contrast with acquisition-led competitors. Some, like Global Payments, have not had a clear day two strategy for the software companies they bought and found themselves supporting legacy products without the capital to invest in a market-leading roadmap. Others, such as Worldline have been unable/unwilling to close superfluous platforms, leaving them with high operational costs and multiple product roadmaps.

Although Finaro was originally bought to provide a platform to support Starlink’s global direct to consumer subscription sales, it first provided Shift4 with European acquiring and strong eCommerce credentials. The Americans have supplemented Finaro’s digital gateway with POS capabilities to create a multi-market unified commerce (UC) product. This has helped win complex European deals in transportation such as supporting EV charging networks from Atlante in Italy and France and Fastned in Northern Europe. The UC platform also supports payment facilitators such as Flatpay in Denmark and, newly announced this week, Curb, the taxi payment specialist in London.

The need to follow Starlink has brought Shift4 the ability to serve customers in a wide range of markets (see below) although it’s not clear, outside Europe and North America, how much capability is with local licences and how much delivered by 3rd parties.

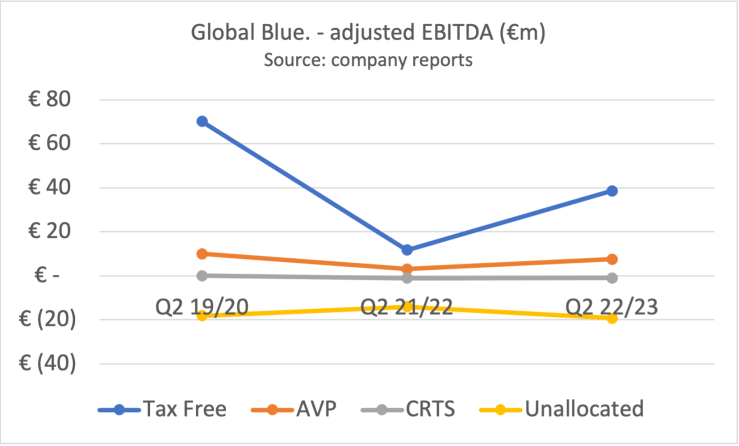

The major news at the Investor Day was the Global Blue acquisition and it certainly could be transformative. Shift4 is paying $2.5bn at a modest 13x EBITDA for the Tax-Free Shopping (TFS) specialist. GB is a well-run, growing business with a quasi-monopoly. If geo-politics don’t intervene, the price is a steal and Shift4 could make its money back even if it delivers no synergies at all.

Global Blue claims almost 80% of the market; processing VAT refunds on $30bn consumer spend at 75,000 luxury goods merchants with a take rate close to 3%. Volume is split 2/3 Europe and 1/3 Asia Pacific. There’s plenty of detail in GB’s investor deck. Shift4 will also be getting a small (€45m rev) but very lucrative (96% margin) dynamic currency conversion (DCC) business and an acquiring licence in Australia.

Shift4’s deal rationale (see slide below) is to cross-sell payments to Global Blue’s retail customers. In Europe, are primarily in France, Spain and Italy. TFS was abolished in the UK in 2020 and Global Blue exited this market.

Shift4 management also believes it has an opportunity to take DCC to Shift4’s US customer base. And there’s potential in better monetising Global Blue’s database of 15m rich people who like shopping and travel.

This strategy isn’t unique. Advent, the private equity group, has put together Planet, a business which combines TFS, a unified commerce platform and European acquiring capability. This sounds a lot like what Shift4 is looking to do.

Planet has also bought several ISVs with a focus on hospitality and luxury but cross-selling has proved tough going, financial results have reportedly fallen short of expectations and Advent is rumoured to be looking for an exit. While the Shift4/Global Blue tie-up is undeniably further bad news for Planet, Advent’s unhappy experience shows that execution is as important as strategy.

This isn’t the only risk. TFS is volatile and critically dependent on rich people continuing to travel to buy luxury goods. Global Blue maintains that TFS held up well in the global financial crisis, but airline disruption and economic pressures can result in earnings more cyclical than payment processors are used to. Also the DCC revenue stream is dependent on relationships with more than 50 acquirer partners who may not be keen on putting business with a competitor. Some may move to Fexco which is now the largest independent DCC provider.

Finally, I need to discuss the thing nobody talked about. It’s increasingly impolite to introduce politics to any conversation with strangers in the USA. During the Investor Day nobody mentioned the current unstable geopolitical situation, either from the stage or the floor of the conference. This can’t be ignored; especially for a US business betting big on going global and welcoming two Chinese giants onto its share register.

Ant and Tencent are current shareholders in Global Blue and embed the TFS service in their WeChat and AliPay consumer apps. Following the closure of the GB deal, the duo will be investing directly into Shift4. From a purely business perspective, welcoming two such committed long-term investors can only be a positive for Shift4 but we’re living in uncharted geo-political waters. If US/China relations go bad, things could get tricky despite Jared Isaacman’s friendship with Elon Musk.