The Payment Business

Worldline’s half-year results disappointed investors as its core merchant services division once again underperformed the broader European market. Net revenue in the division fell 7%, while EBITDA dropped 19%, prompting a colossal €4.1 billion impairment, a remarkable figure considering Worldline’s current market cap is just under €1 billion.

The bad news kept coming. Worldline took an additional €142 million write-down on its minority stake in Ingenico, S&P has downgraded its bonds and the Financial Times raises questions about whether the parent company has ready access to cash held in subsidiaries.

The sales slump in merchant services is blamed on a tough SMB environment, particularly in Germany and the Benelux, where Worldline is struggling against the “Tap Pack” of SumUp, Viva.com, myPOS, Flatpay as well as ISV’s offering payments bundled with their retail or restaurant software.

Still, there are some glimmers of hope. External auditors brought in following the “Dirty Payments” scandal reported no further issues. Worldline has successfully offloaded its mobility and e-ticketing unit for €410m, and there are signs of life in markets like Australia, Italy, and Greece. The company also reports solid progress in platform consolidation and has re-entered the UK acquiring market. Worldline’s new management team remains upbeat, targeting a return to growth in 2026, though that promise may sound familiar.

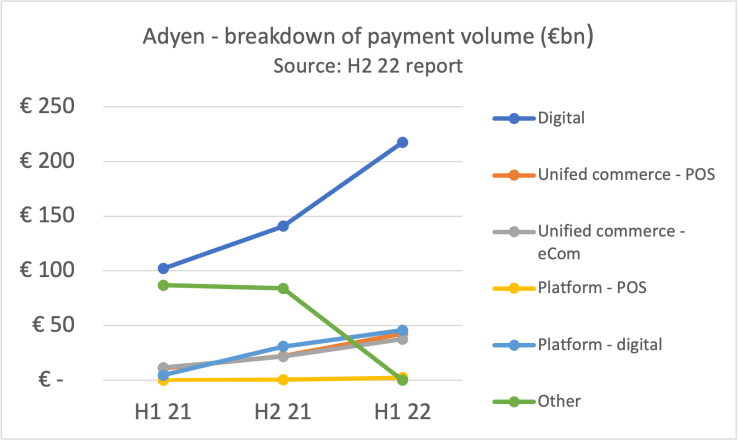

Adyen’s H1 results were quite a contrast. Worldwide revenues grew 20% while EBITDA margins remained above 50%. Very few companies can boast such strong financial results but the stock price fell 18% as the Amsterdam-based acquirer reduced H2 guidance citing the impact of Trump’s tariffs on its Asia-Pacific clients selling goods to the USA. This is thought relate to Shein and Temu suffering from the imposition of customs duties on small packages.S

Despite years of effort and tens of millions of dollars in incentive payments to PSP’s, Discover’s global acceptance network had made little progress in attracting volume. Capital One, Discover’s new owner, is now looking to create a rival to American Express. The CEO said “there are only 2 banks in the world with their own network, and we are one of them. We are moving to capitalize on this rare and valuable opportunity. We need to achieve greater international acceptance and then build a global network brand.”

Dojo has established itself as arguably the UK’s leading SME payments provider but 2024/25 results show growth is slowing – revenue up just 11% and merchant numbers flat. Successful launches in Italy and Spain are critical to the future of the group because, despite a new $190m equity injection, Dojo must run fast to escape the interest payments on its £649 million debt mountain. Read more on the Business of Payments blog.

Today’s CEO normally boasts about using AI to cut staff numbers but FlatPay, the fast growing Danish-HQ’d PF, is delighted to have reached 1000 employees. The hiring spree is linked to new market entry into France and Italy where it is signing 2,400 merchants a month and expects to capture 3% share within 12 months.

The German Sparkasse are some of the few incumbent banks making a success of payments today. Revenue at S-Payment – which provides merchant services to the 353 member banks – was up 17% in 2024, the terminal estate grew 5% and girocard transactions increased 12% – well ahead of the market. Read more on the Business of Payments blog.

Secupay is another German payment business producing good numbers. Based in Dresden, Secupay is the country’s largest remaining independent PSP and processes c.€2bn annually from over 300,000 merchants. 2024 sales almost doubled to €19m. Secupay has recently secured full scheme membership and has built an acquiring capability using Silverflow software.

Deutsche Bank also uses Silverflow and has won its first large customer – Bolt – since relaunching its own merchant acquiring proposition.

Global Payments stock price improved after management reassured investors on the near-term outlook which included Q2 results showing European revenues up 6%, flattered by the weaker dollar.

Global is performing best in central Europe. NBG Pay, the joint-venture with National Bank of Greece inherited from the acquisition of EVO Payments, processed €14bn of in 2024, grew net revenues 25% to €40m and reported a maiden operating profit. Global has entered Croatia with the acquisition of the acquiring unit of Erste Card Club,through its existing Vienna-based JV with Erste Bank.

Although Global has reported positive progress with regulatory matters in the US relating to the acquisition of Worldpay, it’s not commented on the situation in the UK where the combined business will probably have a >40% share of the acquiring market. Competition authorities in London have not yet decided whether to mount a full investigation.

In a busy month for payments-related fundraising, here are some highlights:

- Bumper, based in Sheffield in the UK, secured an additional £8m from the venture arms of Jaguar Land Rover, Suzuki, Porsche and others to expand its car repair software and payments platform to new European markets including Germany, Ireland, Netherlands and Spain. Bumper bought Cocoon Payments, an open banking specialist earlier this year.

- Appcharge, a Tel Aviv based merchant-of-record specialising in helping mobile games publishers take money directly from consumers (avoiding app store charges) has raised $58m, bringing total financing to $89m. Appcharge claims $500m annual payment volume and growing quickly.

- Reckon.ai, from Porto, has raised a further €5.1m (total of €8.5m) to grow its business selling autonomous smart cabinets – best thought of as walk-in vending machines where shoppers pay via an app or by tapping a payment card before entering.

- Handwave, based in Latvia has raised $4.2m for its biometric payment products – hardware and software. You first must link your card credential to your palm print and then you can pay by putting your hand on a special reader. Palm payments make sense for saunas and swimming pools but, otherwise may be a solution looking for a problem.

- MyPinPad, the Cardiff-based SoftPOS vendor, has raised a further £4.6m.

- Papercut, based in Sofia and led by ex-SumUp execs, has raised €2m for its BNPL aggregation service for SMEs. Embed is providing the payment infrastructure and money movement.

Turning to corporate activity, Payroc, a highly acquisitive US acquirer/processor, has bought Bluesnap, an online PSP and payment gateway based in Dublin and Boston. Payroc processes $115bn from 190,000 merchants and the deal gives it significant reach into Europe for the first time.

PayRetailers, a Barcelona-based PSP specialising in cross-border sales into Latin America, has acquired Celeris, an Amsterdam-based payment orchestrator. The deal should help PayRetailers improve authorisation rates.

Finally, Nexi has retained its partnership deal with Crédit Agricole in Italy, despite the bank’s French parent having bought a 7% stake in Worldline in 2024. This will come as a relief to Nexi’s management as it has been under pressure from Worldline for bank partnership in Italy. The Crédit Agricole deals covers processing for 100,000 POS terminals and 3m payment cards.

Scheming

Q2 2025 was another storming quarter for the schemes in Europe. Combined Visa and Mastercard payment volume rose 18% although the headline figure was flattered by the weak dollar. But 12% in Euro terms is still very impressive and reflects 10% growth in transactions and 2% uplift in ATV.

Mastercard and Visa have been neck and neck for a while but in Q2 Mastercard processed (marginally) more volume in Europe than Visa for the first time. This will be cause for a small celebration in Waterloo although Visa still managed a slightly higher number of transactions.

Cross‑border volumes remain robust for both networks; despite Adyen’s issues, neither reports geopolitics hurting demand with Visa’s CEO saying: “We see no meaningful impact from tariffs.”

Europe’s reliance on Visa/Mastercard – 13 of 20 eurozone countries use them for most POS payments – is spurring work on the digital euro (see below) and the European Payment Initiative’s wero wallet.

In Germany, the savings banks, which have integrated wero into the Sparkasse app, now claim 1m active users. For now, wero only works for P2P payments but eCommerce is coming later this year and merchants will certainly like the pricing. S-Payment is proposing 0.77% + gateway charges: rather cheaper than cards or PayPal. And, unlike open banking payments, wero comes with a payment guarantee.

Launching any new payment method is difficult but consumer awareness of wero has grown from 12% to 30% in Germany over the last 12 months thanks to some sustained marketing such as this determined effort to have wero adopted at flea markets.

Wero is also live in France although pitched as something rather cooler and cosmopolitan.

Turning to domestic schemes: Poland’s Blik, which has Mastercard as a key shareholder, posted standout 2024 results with revenue up 93% to €98m (~€0.06/tx) and profit at €48m.

Growth continued in H1 2025: total transactions were up 24% including almost €2bn of POS volume, managed through a virtual Mastercard which also allows Poles to use Blik at terminals abroad. Feel the chemistry as Mme Curie buys supplies in Paris.

Customers of Caixa Bank, BBVA and Santander can use Bizum, the fast-growing Spanish mobile payment wallet at POS for the first time. In contrast to Blik, the Bizum user experience is clunky – shoppers need to type their phone number into terminal to be sent a payment link.

Brazil’s Pix mobile wallet has attracted global attention for its stratospheric growth but seems to be taking share from cash, not cards. Since Pix launched in 2020, card transactions have been growing faster than ever – an annual growth rate of 20% compared to 14% in the previous years. Despite this, Donald Trump has launched an investigation into Brazil’s unfair trade practices including Pix which he says discriminates against Visa and Mastercard. Brazil’s President responded: “PIX is Brazil’s. We will not accept attacks on PIX, which is the patrimony of our people.”

ISV

The shift in payments distribution from banks to software vendors (ISVs) is one the biggest disruptions in the industry and is delivering big numbers to processors that have invested in building the right relationships.

Shopify, which provides websites for over 5m merchants worldwide, has aggressively shifted volume from 3rd party gateways (chosen by the merchant) to its in-house product – Shopify Payments. Processed via Stripe, Shopify Payments’ volume was up 38% in Q2 to $41bn and accounts for two-thirds of all sales made by Shopify merchants.

Stripe tends to be the partner of choice for eCommerce ISVs but Adyen’s platforms business is the go-to acquirer for vendors serving online and store-based channels. Latest results show Adyen’s payment volume from platforms up 80% to €27bn in H1 2025 from 255,000 terminals. 31 of its partners now process over €1bn each annually.

Adyen’s deployment capability in multiple countries and across channels is very attractive to retail software specialists that need a single solution for their multi-national clients. Sitoo from Sweden is a great example. From Sitoo’s perspective the key USP of partnering with Adyen is an increase in first-time help desk resolutions and reduction in time taken to troubleshoot faults.

Other payment processors want a piece of the action. Worldpay is finally taking the European ISV market seriously with some strong marketing support for the launch of Worldpay for Platforms. The proposition is based on the acquisition of Payrix in 2022

Electronic Payments, has bought Handpoint the Iceland-based mPOS vendor. Handpoint, which claims 100 ISV partners, processes $2bn annually from 18,000 devices in Europe and the USA. Electronic Payments is known for giving generous commercial terms to its partners (URL = www.residuals.com) and could be a disruptive new entrant to many European markets.

New shopping

Agentic commerce has potential to transform online shopping; replacing the established online commerce journey which begins with a Google search and ends at a finely honed checkout page with a chat-based conversation between you and an agent that has delegated authority to spend money with your payment card.

In surveys, 50% of Americans are already using AI agents for shopping which is leading to a speedy reassessment of online retail. Anecdotal evidence suggests that small speciality retailers are seeing 20-40% drop in visits as AI prefers to funnel shoppers to large brands. Here’s a good round-up of what merchants are finding.

A16z, a top US venture capitalist, looks at the scenarios and concludes that Amazon and Shopify (which together account for 50% of US eCommerce sales) have strong enough differentiators to prosper in this coming shift. The retail giants want agents to play on their terms and interact based on published APIs. Both have blocked AI bots from crawling their extensive data.

Instead, Shopify has given each of its 5m merchants a “chatbot accessible storefront API”and launched Shopify Catalog which aggregates products across all Shopify merchants to enable AI agents to search, recommend and (in the near future) transact. Shopify claims 12.3% conversion on AI-assisted shopping compared to 3.1% the old-fashioned way.

The payment industry has begun to launch product. Worldpay has introduced a Know Your Agent (KYA) framework to help merchants determine whether an agent is good (working for a genuine shopper with funds to complete the purchase) or bad (working for a scammer). Trulioo, the global ID vendor, is behind the product and has a helpful white paper here.

Open banking

Industry commentators have focused on the positive aspects of the UK’s National Payment Vision, notably a commitment to form a new delivery company, create a payment guarantee and find a commercial model that rewards all market participants. These all may take some time. Meanwhile, investors worry whether the open banking industry – suffering from low volumes and lower margins – can remain solvent long enough to see the fruits of these endeavours.

One example is Ordo, a high profile open banking startup which featured in last year’s Fintech 40. Ordo was bought by Neonomics of Norway in 2023 but the new owners have given up on UK open banking and Ordo has ceased trading. Writing on LinkedIn, Neonomics CEO said VRP (the open banking equivalent to direct debit) had been too slow to arrive resulting in a UK market size of just c.30m transactions/month. This is not enough to sustain an industry.

Mollie, the very well-funded Dutch PSP, is reported to be close to acquiring GoCardless, the loss-making London-based direct debit specialist after Trustly declined the deal. If true, this indicates investor nervousness as Mollie would be unlikely to match the $2.1bn valuation attached to GoCardless 2022 funding round.

Thanks to partnerships with FIS and Visa, and backed by blue-chip investors including NAB, Citi and Rapyd, Banked – another high profile open banking start-up – will be well positioned if/when A2A merchant payments become mainstream. Meanwhile, 2024 accounts show that Banked generated just £700K revenue and will likely need yet more capital to supplement the £55m already raised.

On the positive side, it’s increasingly common to see open banking offered at checkout. Ryanair, working with TrueLayer, has started putting “pay by bank” first on its payment page as you can see below.

Open banking’s current lack of consumer protection will aways be an issue in travel payments. Meagan Johnson gives an example of an A2A transaction for which neither Air France, Trustly or Monzo will take responsibility. Next time, she says she will use a card.

It’s clear that open banking needs “scheme rules” that give clear guidelines for managing disputes. Following two recent product launches, it’s increasingly likely these will be card scheme rules. Following the announcement of Visa Protect earlier this year, Mastercard has followed suit with A2A Protect. Early adopters include NatWest, Santander and Monzo in the UK.

Crypto corner

Plans for the digital euro are accelerating. Regulators already worried about European over-dependence on American payment schemes are now equally concerned about a possible tsunami of dollar denominated stablecoins arriving from the USA.

However, Central Bank Digital Currencies, like the digital euro, are a very different proposition to commercial stablecoins. CBDC’s are designed as cash-substitutes that bring direct benefits to citizens rather than as infrastructure-level plumbing to facilitate international trade. The European Central Bank hopes to have a political deal on the digital euro by early next year.

The commercial banks aren’t happy and paid PwC to write a study that put the cost of digital euro adoption at €30bn if the digital euro sucks deposits out of current accounts leading to banks making fewer loans.

The Bank of England, apparently unbothered about payment sovereignty, is said to be cooling on the digital pound.

Turning to crypto proper, Stripe has begun developing its own blockchain. Simon Taylor is very excited about this.

There are still few signs of crypto (stable or unstable) being used for retail payments. Undeterred, SpacePay, based in London, is raising $1.1m from the sale of its $SPY tokens, to promote crypto currency acceptance on its Android payment terminals. SpacePay says it charges just 0.5% and settles in fiat currency.

Coinbase, a platform that allows people to buy/sell crypto, is running adverts in the UK suggesting that investing gambling in crypto is the solution to inflation, stagnating wages, crumbling infrastructure and a withering welfare system. This won’t end well.

In other news

Numia won the merchant acquiring business of Banco BPM from Nexi last year. One of the first deliverables is “100 kiosks in 100 churches” allowing the faithful to make contactless donations.

German banks stopped €10bn of suspicious direct debits from PayPal following a failure in the US giant’s security systems.

Netherlands Railways has blocked virtual cards issued by Revolut, Paysafe and Vividfollowing discovery of a loophole that allowed passengers to travel for free. People would create a virtual card, take a trip, and then delete the card before the overnight settlement run.

Pedro Carvalho, sales director at Primer, which supplies payment infrastructure to large merchants, has spent the summer posting checkout crimes on LinkedIn. Here’s my favourite – the merchant asking shoppers to choose the processor. Why?

It’s been a busy summer for payment outages. In Denmark, Nets went down and paralysed traffic at the Great Belt Bridge. In France, SocGen and La Banque Postale went down two days in a row with Crédit Mutuel and CIC also failing for two hoursone Saturday evening.

Shopify’s head of engineering gives advice on how to use AI. He says get your lawyers to default to “yes” and don’t skimp on letting your staff subscribe to the best tools. “If your engineers are spending $1,000 per month more because of LLMs and they are 10% more productive, that’s too cheap. Anyone would kill for a 10% increase in productivity for only $1,000 per month.”

Sam Altman says AI will kill KYC as we know it. Risk systems need to be “always on” to cope with the growing wave of deepfakes, spoofing and voice-cloning, he says.

The team behind PayEye, a high-profile facial recognition payment solution, are now in a legal dispute in Poland about who owns the intellectual property.

And finally

How does a Shift4 logo get on an Adyen terminal? An Adyen exec responds: “What you’re seeing is an odd choice of background image, which is fully customizable on any of our terminals.”

Photo credit: James Lloyd

Where to find me

I’ll be at the Checkout.com’s conference in Venice 7-9 October, at the ESPM meeting in London on 23 October, at the ePay Summit in London on 28 October and MPE in Berlin next March.